Field-Programmable Gate Arrays (FPGAs) have become critical tools in high-frequency trading (HFT) due to their ability to deliver ultra-low latency, deterministic performance, and parallel processing capabilities. Below is a step-by-step guide on how to leverage FPGAs for HFT:

1. Understand the HFT Workflow

High-frequency trading involves:

- Market Data Ingestion: Receiving and decoding financial data feeds.

- Signal Processing: Analyzing data to identify trading opportunities.

- Order Execution: Sending buy/sell orders with minimal delay.

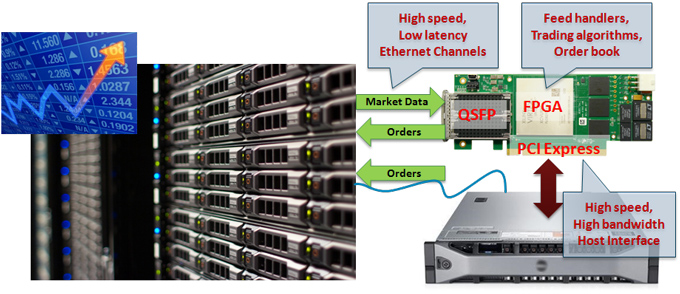

FPGAs are typically used in the market data ingestion and order execution stages because of their ability to handle tasks with extremely low latency.

2. Choose the Right FPGA Platform

When selecting an FPGA, consider:

- Low-Latency Performance: Prioritize FPGAs with high-speed transceivers and deterministic response times.

- Networking Support: FPGAs with 10G/25G Ethernet interfaces are commonly used.

- Vendor Ecosystem: Xilinx (AMD) Alveo and Intel Stratix or Arria series are popular choices.

- Resource Availability: Ensure sufficient LUTs (Look-Up Tables), BRAM (Block RAM), and DSP blocks for computational tasks.

3. Design the FPGA Architecture for HFT

Key design considerations:

a. Market Data Feed Handler

- Parse financial feeds like FIX, FAST, or ITCH protocols.

- Implement UDP/TCP stack on FPGA to handle high-speed data packets.

b. Trading Algorithm Implementation

- Embed trading strategies directly onto the FPGA.

- Optimize latency-sensitive decision-making logic (e.g., statistical arbitrage, market-making).

c. Order Execution Engine

- Implement ultra-fast order routing to trading exchanges.

- Support pre-trade risk checks directly on FPGA to meet regulatory requirements.

d. Latency Optimization Techniques

- Use pipelining and parallel processing for critical paths.

- Minimize off-chip memory access to reduce latency.

- Optimize clock frequencies for critical modules.

4. Develop with FPGA Design Tools

- Xilinx Tools: Vivado, Vitis, and Vitis HLS (High-Level Synthesis).

- Intel Tools: Quartus Prime, Intel HLS Compiler.

- High-Level Synthesis (HLS): Write FPGA logic using C/C++ rather than traditional VHDL/Verilog.

- Latency Analysis Tools: Use timing analyzers and profiling tools to identify bottlenecks.

5. Integrate with Software Stack

- FPGAs are often paired with host servers (e.g., x86 systems).

- Use PCIe (Peripheral Component Interconnect Express) for FPGA-host communication.

- Offload latency-critical tasks to FPGA while retaining flexibility on the software side.

6. Real-Time Monitoring and Debugging

- Use Integrated Logic Analyzers (ILAs) for FPGA debugging.

- Implement real-time telemetry for monitoring FPGA performance and latency.

- Maintain failover mechanisms in case of FPGA failure.

7. Test in a Simulated Market Environment

- Test FPGA designs in paper trading simulations to validate strategies.

- Ensure compliance with regulatory standards like MiFID II (Europe) and SEC (U.S.).

- Stress-test under high data loads to ensure reliability.

8. Deploy to Production Environment

- Deploy FPGAs in low-latency colocation data centers near exchange servers.

- Use redundancy and failover systems for high availability.

- Continuously monitor and optimize FPGA configurations for changing market conditions.

9. Regulatory and Compliance Checks

- Ensure pre-trade and post-trade checks are implemented on FPGA.

- Log FPGA activities for audit trails and regulatory reporting.

10. Continuous Optimization

- FPGA-based trading systems require ongoing optimization.

- Update FPGA firmware regularly to adapt to new protocols or trading strategies.

- Benchmark performance against competitors.

Advantages of FPGAs in HFT

✅ Ultra-Low Latency: Nanosecond-level latencies are achievable.

✅ Deterministic Performance: Consistent processing times.

✅ Parallel Processing: Process multiple data streams simultaneously.

✅ Hardware-Level Customization: Tailor the FPGA to match trading strategies.

✅ Energy Efficiency: Lower power consumption compared to GPUs.

Challenges and Considerations

❗ Development Complexity: FPGA programming requires specialized skills.

❗ High Costs: FPGA cards and expertise can be expensive.

❗ Limited Flexibility: Changes in trading logic require firmware updates.

❗ Regulatory Compliance: Strict rules for algorithmic trading systems.

Popular FPGA Solutions for HFT

- AMD Xilinx Alveo U50/U200/U250

- Intel Stratix 10 FPGA

- BittWare FPGA Cards

- LDA Technologies’ Ultra-Low Latency FPGAs

By leveraging FPGAs effectively, trading firms can achieve minimal latencies, enabling them to execute trades ahead of competitors and capitalize on fleeting market opportunities.